Digi Mobile Subscribers dropped to 11.78 million in 1Q17

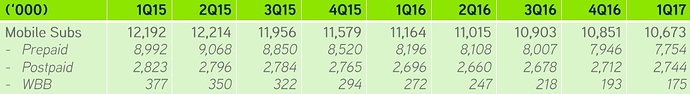

Digi reported its First Quarter 2017 (1Q17) financial results last Friday. There are now 11.78 million Digi mobile subscribers, down (-523k) from 12.3 million subscribers it had in 4Q16.

As of March 2017, Prepaid subscribers stood at 9.59 million, down from 10.2 million subscribers it had as of December 2016. Digi lost 613k prepaid subscribers between January 2017 and March 2017.

The Telco performed better when it comes to Postpaid. Digi added 90k postpaid subscribers in the quarter due to “favourable postpaid take-up on entry level 4G plans, prepaid to postpaid conversions” and “solid interests from exclusive online deals”. Digi Postpaid subscribers now stands at 2.19 million.

Prepaid ARPU is at RM32 down from RM34 while Postpaid ARPU is at RM79, down from RM81 (4Q16).

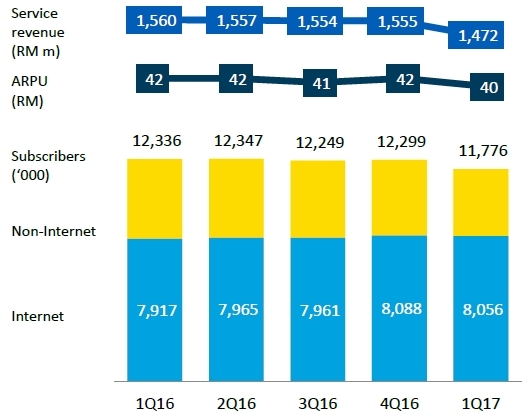

Digi said it has 8 million mobile internet subscribers where 60% of its smartphone subscribers are using 4G LTE and 40% on 3G. There are 4.7 million 4G LTE subscribers.

4G LTE-A coverage now stands at 42% of the population nationwide, measured at the lowest signal quality of -110dBm. It claims 4G LTE coverage to be at 85%, supported by a 7,700km of fiber network. Digi said the 4G LTE network is ready to support LTE 900Mhz and can be activated once approval is obtained from the Government.

The mobile operator also revealed that some 1.7 million subscribers now uses the new MyDigi app for bill payments, reloads and quota top-up transactions.

Key Financial Highlights, according to Digi (Y-o-Y):

-

Higher earnings before interest, tax, depreciation and amortisation (EBITDA) to RM711m or 45% margin on the back of improved gross profit and well-managed cost structure -

Internet revenue grew 15.2% from last year to RM621 million contributing 42.2% to service revenue as smartphone adoption rose to 68.0% -

Postpaid revenue growth remained solid at 12.1% with postpaid revenue at RM520 million mainly fueled by stronger subscriber base -

Service revenue moderated 5.6% to RM1,472 million underpinned by sharper focus on sustainable earnings and stronger margins. Profit After Tax (PAT) healthy at RM373 million or 24% margin • First interim dividend of 4.7 sen per share or RM365 million

Digi CEO Albern Murty said, “This was a busy quarter for us as we focused on maintaining our margins, amid challenging market conditions. We are responding to these persistent market conditions with a long-term strategy anchored by our continued focus on postpaid, profitability and our digital transformation.

“We have made strategic decisions with our core business today to secure future growth and profitability – that is, to deliver great, worry-free and affordable internet services over our advanced 4G+ network which has fueled solid postpaid growth in the past quarters, stabilise prepaid to enable more sustainable earnings and opportunities moving forward, pay diligent attention to improve the efficiency of our operating model while maintaining a larger network and more advanced IT infrastructure.

“Our performance and improved profitability in the quarter is a result of our overall digitisation efforts, focus on resilience and securing our financial strength. These efforts have led to our balance sheet remaining robust with solid financial capability and flexibility to fund our investments and operational commitments to move our business forward and into the future.”

Source: Malaysian Wireless