Nuffnang founders Cheo Ming Shen & Timothy Tiah at the ASX IPO in July 2015.

Netccentric Limited is the parent company of Nuffnang & Churp Churp. The tale of two co-founders who successfully listed their startup in Australian Securities Exchange (ASX), turning each other to be the enemy of a lifetime.

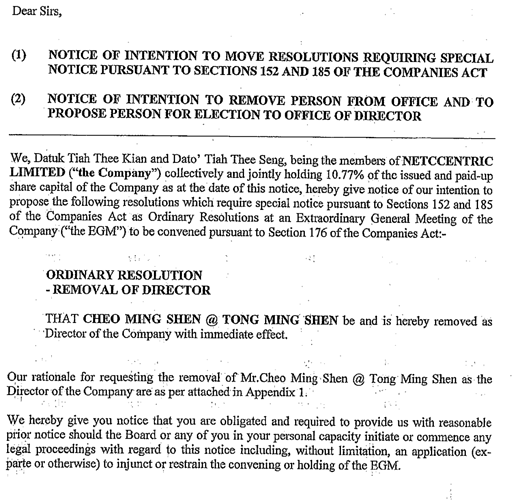

Cheo Ming Shen (aka Boss Ming):

At the outset, I am deeply concerned about the intentians of [Tiah Thee Kian and Tiah Thee Seng (collectively, the “Tiahs”)] and their purported reasons justifying my removal as a director. In my capacity as former CEO and director of the [Netccentric Limited (the “Company”)], I wish to clarify some facts for the benefit of all shareholders so as to assist everyone in making an informed decision.

The Tiahs’ actions are not made in good faith and for a collateral purpose

As some of you may know, I have commenced legal proceedings against Timothy Tiah (“Tim”) in HC/S 244/2017 (“Suit”). Whilst I am advised by my solicitors not to comment on the Suit and the ongoing proceedings and will not do so, I believe that the following information is relevant to these representations:

- It is undisputed that prior to the Suit, I have always been at the helm of the Company as CEO and had worked closely with Tim, the then-COO;

- In the Suit, I have alleged that a year after the Company’s listing, more specifically around July 2016, Tim and I started having disagreements over the direction and management of the Company. As a result of these disagreements, the both of us initiated a series of discussions from September to October 2016 where Tim and myself agreed that it would be in the interests of the Company for me to continue leading the Company as its CEO and for Tim to step down as COO;

- It is significant to note that as part of this agreement, it was agreed between Tim and myself that I would be able to lead and manage the Company as its CEO and director without any disturbance or interference from him. However, this came with a catch Tim expected to be adequately remunerated by the Company;

- Subsequently, pursuant to further discussions between myself, Tim, Pierre Pang and Andrew Bursill in early October 2016, it was agreed, inter alia, that in consideration of a total package, summing up to 596,000 AUD to be paid to him by the Company, Tim agreed not to interfere or in any way affect my management of the Company as its CEO for a period of 3 years and in particular, by not returning to C-suite level management of the Company;

- The above payment terms were eventually recorded and executed in a written agreement titled “NETCCENTRIC LTD (THE "COMPANY) … NON-COMPETE AGREEMENT AND APPOINTMENT AS ADVISOR dated 1 November 206 which was signed by Tim on that same day which he resigned as COO of the Company; and

- My position is that the various agreements as set out in pararaphs 4.b. to e. above formed one over-arching agreement, which I will refer to as the “Agreement”.

However and since as early as 23 January 2017, Tiah Thee Kian wrote to the Company on a TA Global letterhead (“TA Letter’), which I annex to these representations.

The Tiahs are now farcically relying on the exact same reasoning that they cited to demand my removal as CEO 8 months ago, to have me removed as a director on the board.

It is also apparent from the words in the letter, “Collectively we represent a significant shareholding block in the company and we insist this action be taken urgently by the board, that Tim and the Tiahs are working together in concert to wrongfully remove and deprive me of management of the Company and of a seat on the board.

As stated in the Notice itself, the Tiahs only collectively own 10.722% of the Company’s shares, which is barely enough for them to have issued the Notice. It is unbelievable that anyone would consider a mere 10% shareholding as a “significant shareholding block” which I believe must include Tim who owns approximately 36% of the Company’s paid-up shares. Collectively, Tim and the Tiahs own approximately 47% of the total paid-up shares in the Company, which almost gives them a simple majority of votes.

It is therefore clear that Tim, with the support of the Tiahs, have been systematically colluding to completely block me out from management of the Company. I say this because based on their individual shareholdings alone, neither Tim nor the Tiahs have the ability to push for a vote against me.

This is in clear breach of the Agreement which I am now suing Tim for.